The amount of money paid by motorists as tolls on public highways in the country has been abolished by the government.

Given the excessive vehicular traffic, increased travel time, and poor revenue collection at tolling locations on our public roadways, this should come as a comfort to road vehicle users.

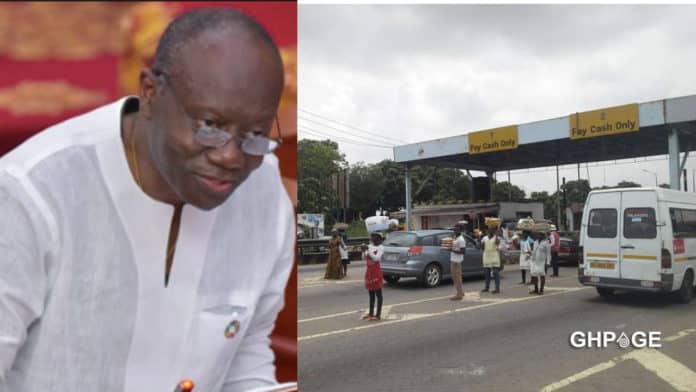

On Wednesday, November 17, 2021, Minister of Finance Ken Ofori-Atta said this during his presentation of the 2022 budget statement and economic policy to Parliament.

The Minister explained the rationale behind the scrapping of road tolls, saying that the state’s revenue for road building and maintenance is insufficient and that the government must search for other ways to equally generate cash for road development and maintenance.

“Over the years, the tolling points have led to heavy traffic on our roads and lengthened travel time from one place to another, impacting negatively on time and productivity. The congestion generated at the tolling points, besides creating these inconveniences, also leads to pollution in and around those vicinities.

He continued; “To address these challenges, the Government has abolished all tolls on public roads and bridges. This takes effect immediately after the Budget is approved. The toll collection personnel will be reassigned. The expected impact on productivity and reduced environmental pollution will more than offset the revenue forgone by removing the tolls.”

The Minister stated that the government is looking to develop creative ways of earning income to compensate for the road tolls, such as the proposed 1.75% electronic transactions fee.

He said this will help the government to shore up revenue inflows to fund road projects in the country.

After considerable deliberations, Government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector. This shall be known as the ‘Electronic Transaction Levy or E-Levy.’ Electronic transactions covering mobile money payments, bank transfers, merchant payments and inward remittances will be charged at an applicable rate of 1.75%, which shall be borne by the sender except inward remittances, which will be borne by the recipient,” he explained.

“Mr. Speaker, to safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GH¢100 or less per day (which is approximately GH¢3000 per month) will be exempt from this levy. A portion of the proceeds from the E-Levy will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others. 3y3 Baako, Ye nyinaa bey tua. Mr. Speaker, this new policy also comes into effect (once appropriation is passed) from 1st January, 2022. Government will work with all industry partners to ensure that their systems and payment platforms are configured to implement the policy,” Ken Ofori-Atta told Parliament.