The Ghana Revenue Authority has released a statement which suggests the payment of tax or levy on gifts.

In a social media post which generated backlash from many Ghanaians, the GRA had intimated that whenever a gift is received, the recipient must notify the authority and pay the required tax.

When an individual receives a gift, returns must be filed at the Ghana Revenue Authority within 21 days, the GRA has said.

In a nutshell, anytime a gift is received which is outside of business or employment, an individual is mandated to notice the commissioner of the Ghahan Revenue Authority and pay a tax on the items received.

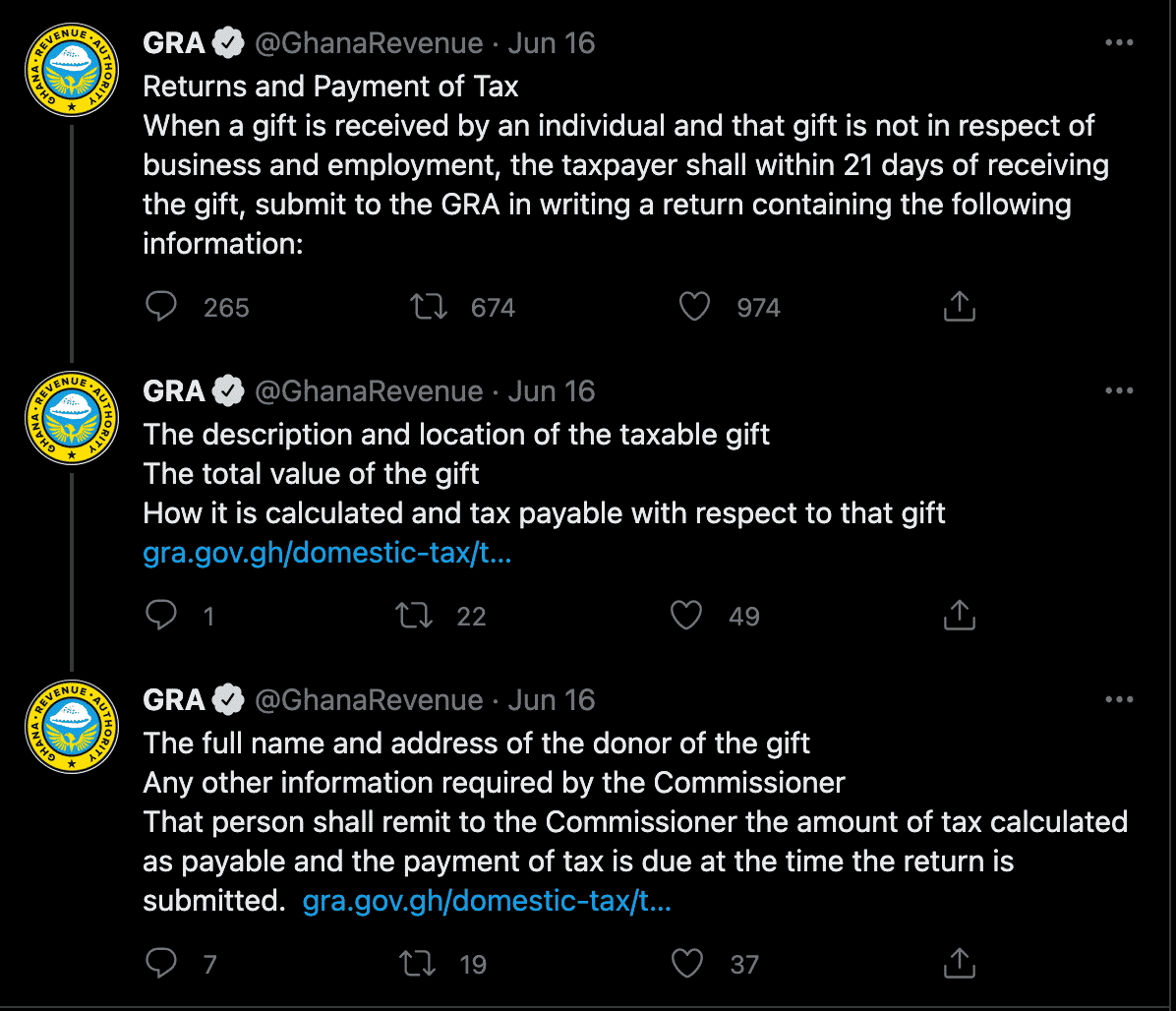

The Ghana Revenue Authority in a social media post wrote:

Returns and Payment of Tax When a gift is received by an individual and that gift is not in respect of business and employment, the taxpayer shall within 21 days of receiving the gift, submit to the GRA in writing a return containing the following information:

The description and location of the taxable gift

The total value of the gift

How it is calculated and tax payable with respect to that gift

The full name and address of the donor of the gift

Any other information required by the Commissioner

That person shall remit to the Commissioner the amount of tax calculated as payable and the payment of tax is due at the time the return is submitted.

Aside from E-levy, it is obvious Ghanaians would need to pay the domestic tax on gifts received henceforth.