Scamming schemes are fraudulent schemes performed by a dishonest individual or groups in an attempt to obtain money or something of great value.

Scams typically involve promising the victim a significant share of a large sum of money, in return for a small up-front payment, which the fraudster requires in order to obtain the large sum.

If the victim makes the payment, the fraudster either invents a series of further fees for the victim or simply disappears.

After the internet became widely used, new forms of scams emerged such as lottery scams, love scams, gold scams, phishing or requesting for help.

In recent times, Ghana has experienced a lot of scamming schemes where numerous Ghanaians have been frauded of millions of cedis.

In 2015, the Bank of Ghana became aware of some five unlicensed microfinance companies who were operating illegally namely God is Love Fan Club, Jaster Motors Investment Limited, Little Drops Helping Hands Association, Perfect Edge Group and Care for Humanity International Fun Club.

ALSO READ: List of NAM1 businesses released

Below are some scamming schemes that hit Ghana in recent times and affected several people and businesses in the country.

DKM Diamond Microfinance LTD

DKM was a duly licensed microfinance company which obtained its license on 25th October 2013. The company which was in Sunyani promised depositors a fifty per cent interest on their deposits over two months.

Such initiative drove residents of Sunyani and other parts of the Brong Ahafo region to invest with DKM Microfinance.

The Bank of Ghana came to the realisation that the company has committed some regulatory and supervisory breaches that threatened the safety of customers funds. Several opportunities were given to the company to turn their operations around which they failed to do.

This resulted in Bank of Ghana revoking their license on 29th March 2016. Many customers were affected as some took loans from other banks and deposited the money for 50 per cent return.

ALSO READ: Kennedy Agyapong engages in a brawl with minority whip in parliament

God Is Love Fan Club

This fan club is known to be allegedly owned by NPP Parliamentary aspirant for the Kintampo North Constituency, Alexander Gyan.

The fan club frauded several people in the Brong Ahafo Region millions of cedis and rendered business bankrupt and several homes are broken.

The fan club owns millions of cedis to its depositors as a result of its unregulated operations.

Little Drops Helping Hands Association

This fan club also was disguised as a microfinance institution but was not licensed by the Bank of Ghana.

On January 13, 2016, the National Chairman of the Ghana Association of Microfinance Companies, Mr Collins Amponsah-Mensah warned Ghanaians over these fan clubs springing up.

He said these institutions were operating under the guise of fun clubs, duping unsuspecting people and causing a mess in the sector.

“These are voluntary institutions and members would come together and say we want to put our money together and we will give it amongst ourselves as loans. It is a different form that is gradually coming up in this country and causing this mess“, he added.

However, this fan club managed to dupe several Ghanaians.

ALSO READ: I invested 2.5 billion cedis in Menzgold -Mzbel

Jaster Motors & Investment

Somewhere in 2015, Bank of Ghana stopped the company from operating due to their violations of the saving and banking laws and regulations.

The company has on several times defied the Bank’s directives and continued to operate contrary to the rules of the banking industries.

Several customers had their monies locked up and cried to the government to help retrieve their deposits.

Perfect Edge Group

This microfinance company was also operating like DKM and God Is love in Sunyani. The company was also shut down by Bank of Ghana for not abiding by the laws governing the banking institutions.

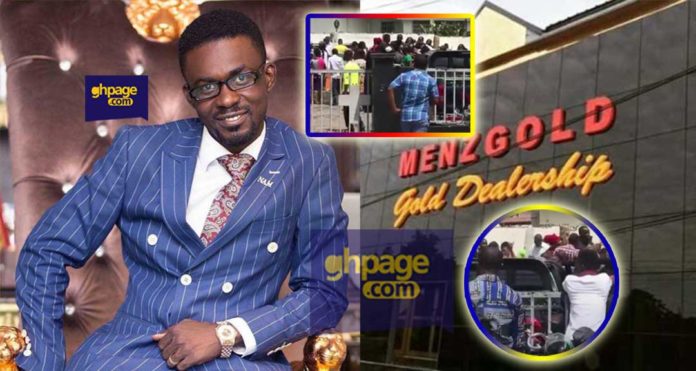

Menzgold

Menzgold which is owned by Nana Appiah Mensah popularly known as NAM1 was operating microfinance called Menzbank.

In 2014, after the Bank of Ghana discovered that Menzbank was operating illegally, they changed their name to Menzbanc.

In 2017, Menzbanc changed its name to Menzgold after the former company was under investigations.

Menzgold was offering an interest rate ranging from 7-12 per cent and got many customers to deposit their monies.

Menzgold was operating a Ponzi scheme (is a form of fraud which lures investors and pays profits to earlier investors by using funds obtained from more recent investors).

Somewhere in 2018, the Bank of Ghana and the Securities and Exchange Commission warned Menzgold from accepting new deposits and pay off initial deposits including their interest.

This led to the shut down of Menzgold and currently, NAM1 is allegedly hiding in Dubai. Also, many customers of Menzgold have taken to the street to demand their deposits.

ALSO READ: Menzgold and how NAM1 succeeded in scamming millions of Ghanaians

However, the Economic and Organised Crime Office (EOCO) has secured a court order to freeze all landed properties and vehicles belonging to Nana Appiah Mensah.

It also ordered all employees of the affected companies, relatives and friends in possession of any of the properties to surrender them to the office.

EOCO also issued a warning to all artists signed onto Zylofon Recor Label to return all the properties given to them by their boss, Nana Appiah Mensah.